My name is José Ramón, I am from Spain, I have over 40 years of experience in living, and so far, I haven’t failed a single day.

I studied telecommunications engineering for more years than I would recommend to my worst enemy.

Fortunately, I started working long before finishing my studies, which made me realize firsthand how easy it is to throw money away without knowing how it is spent.

If I had to teach personal finance in one sentence, I would say: “Don’t smoke.” I first heard about Bitcoin in 2011 when it was worth around 10 dollars.

I quickly saw that Bitcoin was a brilliant idea, but I didn’t buy it because I needed that money to buy cigarettes.

The millions of dollars I didn’t earn in financial terms are what we call “opportunity cost.”

At that time, 10 dollars (actually about 10 euros in Spain) was what I usually had left in my checking account after paying rent, food, and transportation.

I knew down to the last cent how much my groceries would cost before the cashier even told me.

Gaining experience and finishing my studies gave me access to a good salary, and over the years, I have continued progressing, earning more and more.

That has brought me close to the 90th percentile in salary. That means that out of 100 randomly chosen people, I am likely the last in the top 10 highest earners. Impressive? Not really. It’s actually standard for a senior in a qualified profession.

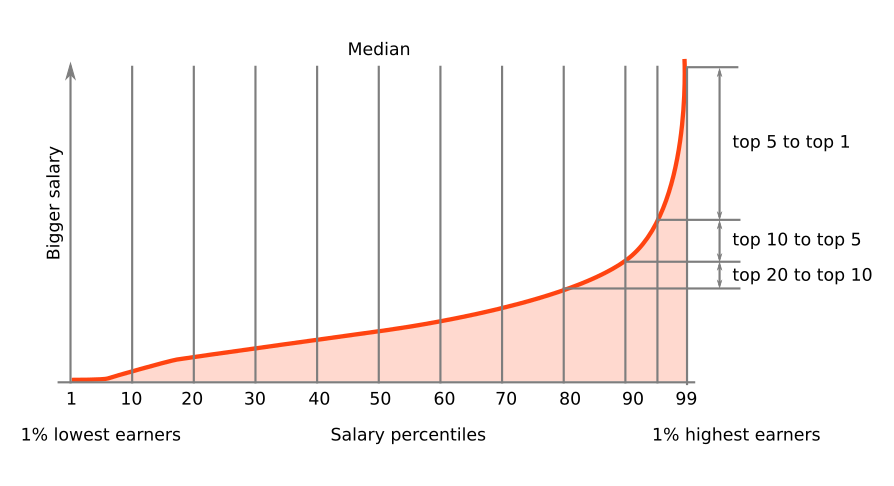

Don’t feel special just because you’re in the top 10 in salary. Given the salary distribution, it’s not a big deal:

Moving from the top 20 to the top 10 is much easier than moving from the top 10 to the top 5. And moving from the top 5 to the top 3 is something only a few manage. The rest is reserved for the chosen ones.

So, should one work hard? Absolutely. But there’s a limit, beyond which you need to think about other strategies. In addition to pursuing a good salary, you must save, invest, protect your wealth, and, above all, plan.

Don’t expect them to teach you this because they have no interest in you learning how to play the game well. If you follow the system’s rules without questioning them, you’ll be working hard for others all your life.

Since we live in a world of uncertainty, plans will most likely need to evolve to adapt to a changing reality.

But that doesn’t mean you can’t have a goal to aim for. In fact, you probably have several goals.

With Financial Transurfing methodologies, you’ll have a clear roadmap to reach those goals—and much more. You’ll gain the knowledge and tools to take control of your finances, increase your wealth, and stand out from the crowd.

A more efficient approach to money means a more relaxed life, greater status, and even increased attractiveness. Plus, you’ll have access to exclusive tools and a community that shares your drive for financial success.

Best regards, and thank you.